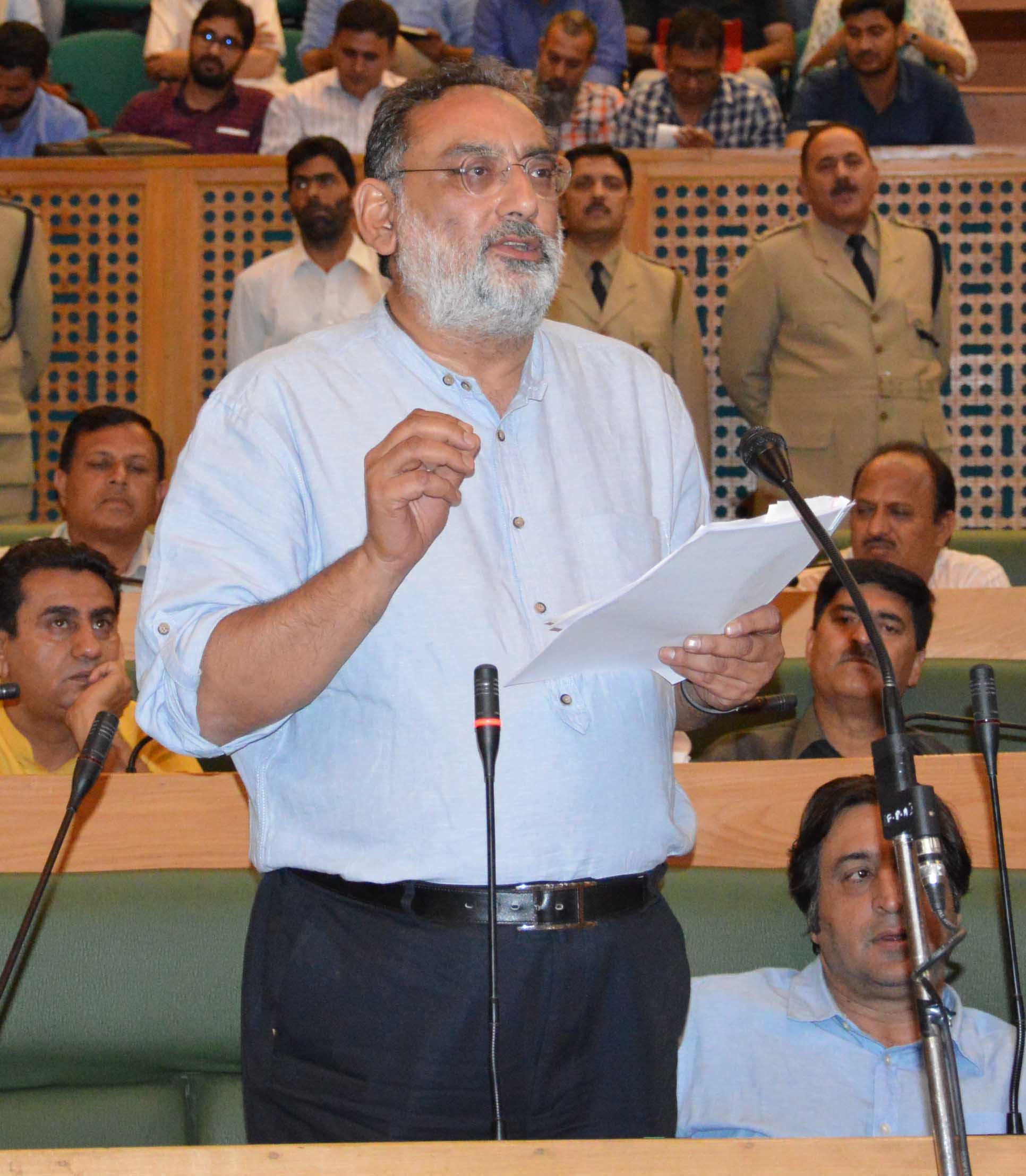

The Resolution on GST was passed by both the Houses of Legislature today amid assurance from the Finance Minister, Dr Haseeb Drabu that implementing Goods and Services Tax (GST) in J&K under the ambit of Article 370, ensuring adequate safeguards for the State’s Special Status and protecting Consolidated Fund and special taxation powers of the State Government are proposed to be incorporated into the Presidential Order for bringing Jammu and Kashmir under the ambit of the new tax regime.

Responding to the concerns of the legislators in J&K Assembly who spoke about the new indirect tax regime over the last two days, Finance Minister, Dr Haseeb Drabu said under no circumstances will the State Government amend the Section 5 of Constitution of J&K which gives it special taxation powers. He said such a move will open a Pandora’s Box which will have implications on the Special Constitutional Position of J&K in future.

“We are proposing that the Article 370 shall not be compromised in any way through the Presidential Order. The GST Council should not be a way to subvert the process and enough safeguards are built to empower the constituents of J&K in the Council. Besides, the exclusive powers of the State to tax and the Consolidated Fund of J&K shall not be impaired,” he said.

Expressing concern about declining trade in J&K due to uncertainty over GST, Dr Drabu said only 1000 truckloads of goods crossed the Lakhanpur Toll Post on July 4, down by half when compared with the figures of the corresponding period of last year. “The exports have also halved with only 150 truckloads of goods moving from J&K to other states. This is adversely impacting our trade and economy,” he said.

The Finance Minister said the State Government is not under any pressure to extend GST to Jammu and Kashmir. “We are not working under compulsion but for the restoration of certain processes and constitutional morality which lays foundation of a true democracy. It is the biggest tragedy of our time that we have lost our tradition of dialogue which is why we brought the resolution for GST to the House to revive that culture of consultation. We wanted a consensus on the issue,” he said.

Dr Drabu said the resolution on GST, which was passed by the House today, is a statement of a principle. “The sense of the House is that no one has issues with GST per se. There might be differences with modalities of applicability which is why we want this law to be backed by the State Government and legislative process so as to prevent any harm to the consumers and trade without compromising on the State’s special position,” he said.

Hitting out at the Opposition for making an issue out of a non-issue, Dr Drabu said the new indirect tax regime is the biggest democratization of public funds in the world and J&K, being a consumer state, will immensely benefit from it.

“We are not touching the Constitution of J&K, so where is the question of violation of basic structure of constitution? Under previous regimes, 94 out of 97 items in union lists have been made to apply to J&K. The Opposition can’t keep on deceiving people by trying to create misconceptions vis-à-vis JK’s Special Status. The Congress issued Presidential Order in 1986 to essentially make laws for the state. After the 1986 ordinance which was effectively the withdrawal of residuary powers of the state, three months later, National Conference formed the Government in the State with Congress,” he said.

The Finance Minister said the GST Council is the first truly federal institution in the country which strikes at the roots of Indian federalism. “India is moving from coercive to cooperative federalism. The Opposition is selectively looking at the loss of powers of states but not one is looking at the loss of powers of union to the GST council,” he said.

Dr Drabu said the Article 370, which gives Special Status to J&K under Indian Constitution, should be protected and used for development of the state and for the empowerment of people. “Instead, it is being used as a tool to whip up political passions and draw political mileage. It is being used for creating fake controversies,” he said. Seeking to allay the fears of business community, he said industry exemptions and tax remissions will continue both from the Centre and the State Government under the new tax regime.

Reacting to the demand of the Opposition to bring a separate GST law for Jammu and Kashmir, Dr Drabu said alternative law will require amending Constitution of J&K and of India. “Amending Section 5 of J&K Constitution will open Pandora’s Box. Instead, what we are proposing is that the GST Council must come within the ambit of Article 370,” he said.

Later, the Finance Minister made similar assertions in the Upper House regarding GST.

After the assurance of Dr Drabu, both the Houses passed with voice vote the Resolution on extension of GST to J&K.

“This House resolves that the Government of Jammu and Kashmir may give consent to the adoption of the GST regime by application of relevant amendments made to the Constitution of India in a modified manner to safeguard the existing special constitutional position of Jammu and Kashmir in the Union of India and the legislative powers under the Constitution of Jammu and Kashmir,” the resolution which was moved by Dr Drabu in the legislature yesterday states.

Earlier, several members from both the treasury benches and the opposition participated in the debate in both Houses on GST Resolution.